Making money is not as hard as you might think. All it takes is a little work, a willingness to learn and adding value to the world around you. You can also try starting your own business or investing in stocks. No matter how you get rich, remember that it isn’t a race. The key is to set goals and stick to them. Here are some tips to help you get started:

Making money isn’t that difficult

You may be thinking that making money is not that hard. But that’s not true. You can earn a decent living with little effort if you know how to use the Internet. There are websites that pay you to complete simple tasks such as typing. Many of these websites have good reviews and a free signup option. You can even try gambling, which is legal in many countries. However, you have to pay attention to the terms and conditions of the sites.

Adding value to yourself

Creating surplus value is the key to financial wealth. As humans, we are valuable to others, and adding value to ourselves is an effective way to create this value. It is easy to see how creating value will make us wealthy, but how do we create it? We must first create value for ourselves before we can add value to others. Let’s take a look at two examples. The first is Steve Jobs who started Apple in his garage. Walt Disney made Mickey Mouse out of a rat-infested low-rent room. Added value to yourself and others is the secret to creating a massive empire.

Starting a business

While there are a number of advantages to starting your own business, you must realize that it is not an easy endeavor. It requires a great deal of planning, organization, and flexibility. Many people who start their own business think that they can make money instantly, but this is not the case. It takes time to see results and to realize that it is not easy to become rich in a business. Keeping accurate records and analytical thinking are vital to success.

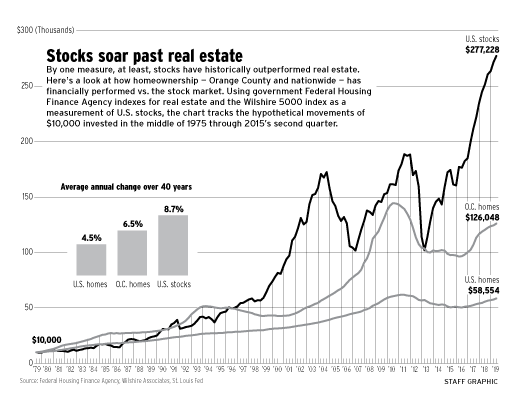

Investing in stocks

The stock market has become a wealth generator because a small group of companies have experienced massive gains. Compound interest is the driving force behind the success of the stock market. Many investors have become rich in the past few years by investing in these stocks. But it is important to remember that the stock market is not a “get rich quick” scheme. The more patience an investor has, the more successful he or she will become.

While most investors are eager to take advantage of the market’s rise, there is no single method to achieve financial success. One way to invest wisely is to diversify your portfolio. For example, if you invest $1 in the S&P 500 index in March 2009, you would have $3 today. On the other hand, if you invested $1 million in the same index, you would have made $3 million in the past two years. This phenomenon has benefited Caucasians and college graduates more than any other demographic.

Another way to invest in stocks is to purchase stocks that pay dividends. Dividends are a good way to secure income even if the company doesn’t make money. Dividends can also be reinvested for a greater return. Some dividend stocks have low debt and strong cash flows, and many offer competitive yields. Different investors have different reasons for investing in stocks. However, everyone should consider their own circumstances before investing in stocks.

Gambling

Assuming that we are living in a post-industrial society, if we aren’t actively contributing to the decline, then why are people gambling? The answer to this question lies in the rise of the gambling industry. Its popularity reflects the zeitgeist of our age. From high-risk, rigged economies to the collapse of faith in institutions, gambling has become the defining pleasure of our time.

In the United States, gambling is widely accepted, with the majority of the population actively participating in it. Many young people are introduced to it by playing card games with their parents or visiting amusement arcades. Although gambling is high-risk, high-yield activity, many people consider the thrill of winning a jackpot alluring despite the low odds. Gambling is one of the few industries that takes advantage of human nature and its urge for risk.

The thrill of gambling is a complex process. It’s not just about winning – it’s also about the process of betting. Whether you’re playing the lottery or a game at the casino, the excitement of a flutter is linked to the game’s structure. While gambling isn’t a source of financial security, it can be a form of entertainment if you’re trying to avoid getting broke.

Investing in real estate

There are many ways to invest in real estate, including buying and holding residential rental properties. In the past, lords and nobles competed for titles that allowed them to collect rent from tenants. Other entrepreneurial types drained swamps and built businesses on land that they rented out. This allowed them to make more money from the land than they would have from leasing it. Investing in real estate is an excellent way to make a profit.

While real estate isn’t for everyone, it can provide many opportunities for wealth accumulation. However, before making a move to invest, investors must educate themselves about the process and strategies for maximizing profits. While there are many risks involved in real estate investing, there is an opportunity for large profits if the right education is obtained. For example, cash is required for a 20% down payment. Moreover, real estate appreciation rates have consistently topped inflation. In fact, property appreciation rates have averaged two to three percent per year for the past thirty years.

However, there are several disadvantages to real estate investing. Most real estate investments are not “liquid” and may not be appropriate for investors who need money quickly. Furthermore, some investments require large capital, while others do not. In addition, some investors choose to pursue real estate training in order to gain experience. The more training an investor receives, the more types of investments they can make. It’s a great way to make money from real estate, but it’s important to understand that it’s not for everyone.

Join The Personal Wealth Creation (PWC)™ – Launching (50% Discount)

Learn How to Develop Wealth at a Personal Level.

On the Personal Wealth Creation, you will learn:

- Beliefs of The Multi-Millionaires

- How the Wealthy Manage their Money

- How to Increase Your Income

- How to Manage your Money & Reduce Your Expenses by 20-35%

- How to Build a Fortune by just Investing 15% of Your Income

- How to Design Your Millionaire Master Plan

- And Much More…

Helpful Links: